Ma payroll calculator

Federal Salary Paycheck Calculator. Let us help you arrange payroll and all other legal requirements.

Massachusetts Paycheck Calculator Smartasset

Contribution rate split for employers with fewer than 25 covered individuals.

. Ad We are specialists in Payroll HR-Outsourcing and handling the payroll process. Employers pay FUTA tax based on employee wages or salaries. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts.

Payroll Tax Calculator Determine the right amount to deduct from each employees paycheck. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. GetApp helps more than 18 million businesses find the best software for their needs. Payroll management made easy.

3 Months Free Trial. GetApp helps more than 18 million businesses find the best software for their needs. Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible.

This online time clock uses a standard 12-hour work clock with am and pm or a 24-hour clock. Automatic deductions and filings direct. View FSA Calculator A.

Ad Read reviews on the premier Payroll Tools in the industry. Small Business Low-Priced Payroll Service. Summarize deductions retirement savings required taxes and more.

The state-level payroll tax is 075 of taxable wage up to 137700 and the income tax is a flat rate of 5. Run your own payroll in. Find out how easy it is to manage your payroll today.

Thus the maximum annual amount of FUTA. Payroll Tax Salary Paycheck Calculator Massachusetts Paycheck Calculator Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or. Use this simple powerful tool whether your.

In 2015 FUTA tax percentage is 06 percent of the first 7000 of wages per year. Starting as Low as 6Month. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

It is perfect for small business especially those new to payroll processing. Employers can use it to calculate net pay and figure out how. Use this calculator to add up your work week time sheet and calculate work hours for payroll.

This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus-only tax. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. It will confirm the deductions you include on your.

Small Business Low-Priced Payroll Service. A single filer will. Massachusetts Massachusetts Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent.

3 Months Free Trial. Why Gusto Payroll and more Payroll. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Free Online Payroll Tax Calculator. Well do the math for youall you need to do is. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

How much do you make after taxes in Massachusetts. Ad We are specialists in Payroll HR-Outsourcing and handling the payroll process. For example if an employee earns 1500 per week the individuals annual.

All other pay frequency inputs are assumed to. Let us help you arrange payroll and all other legal requirements. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

Heres a step-by-step guide to walk you through. The payroll calculator from ADP is easy-to-use and FREE. Ad Read reviews on the premier Payroll Tools in the industry.

Important Note on Calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use this paycheck calculator to figure out your take-home pay as an hourly employee in Massachusetts.

ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly.

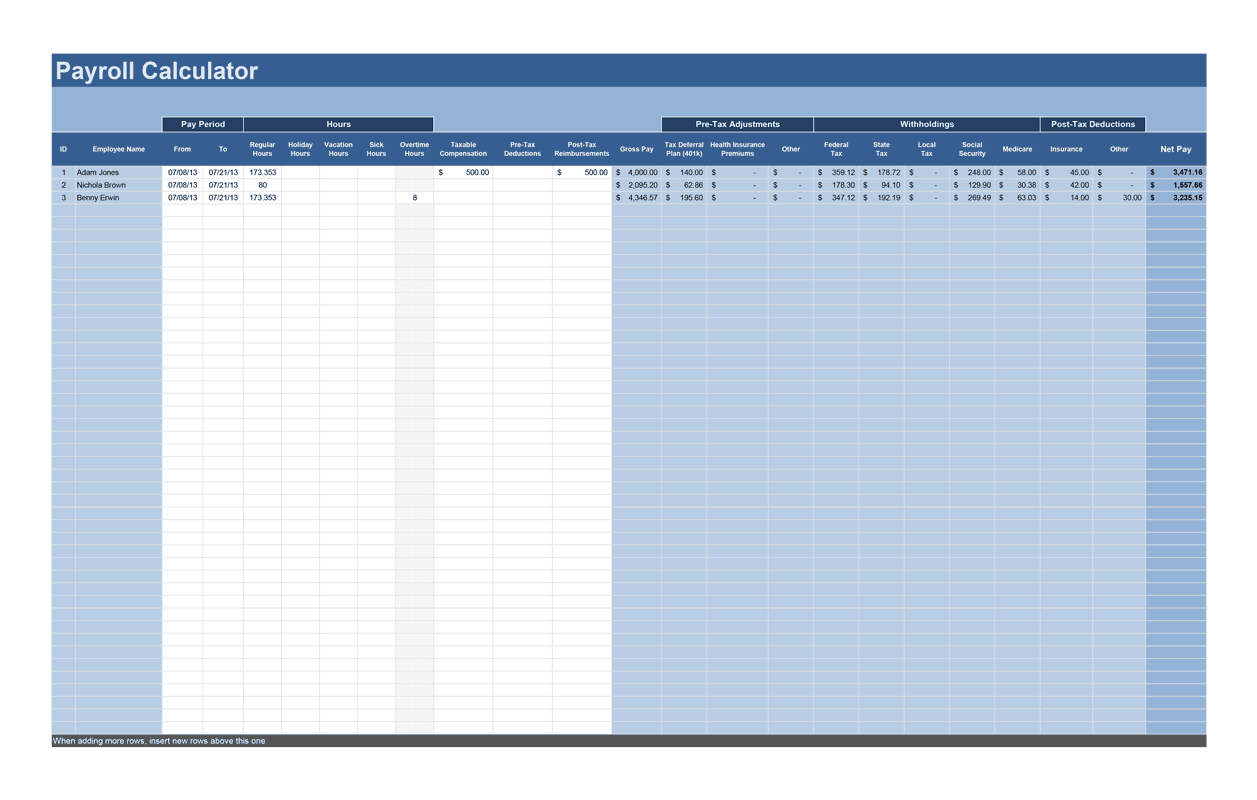

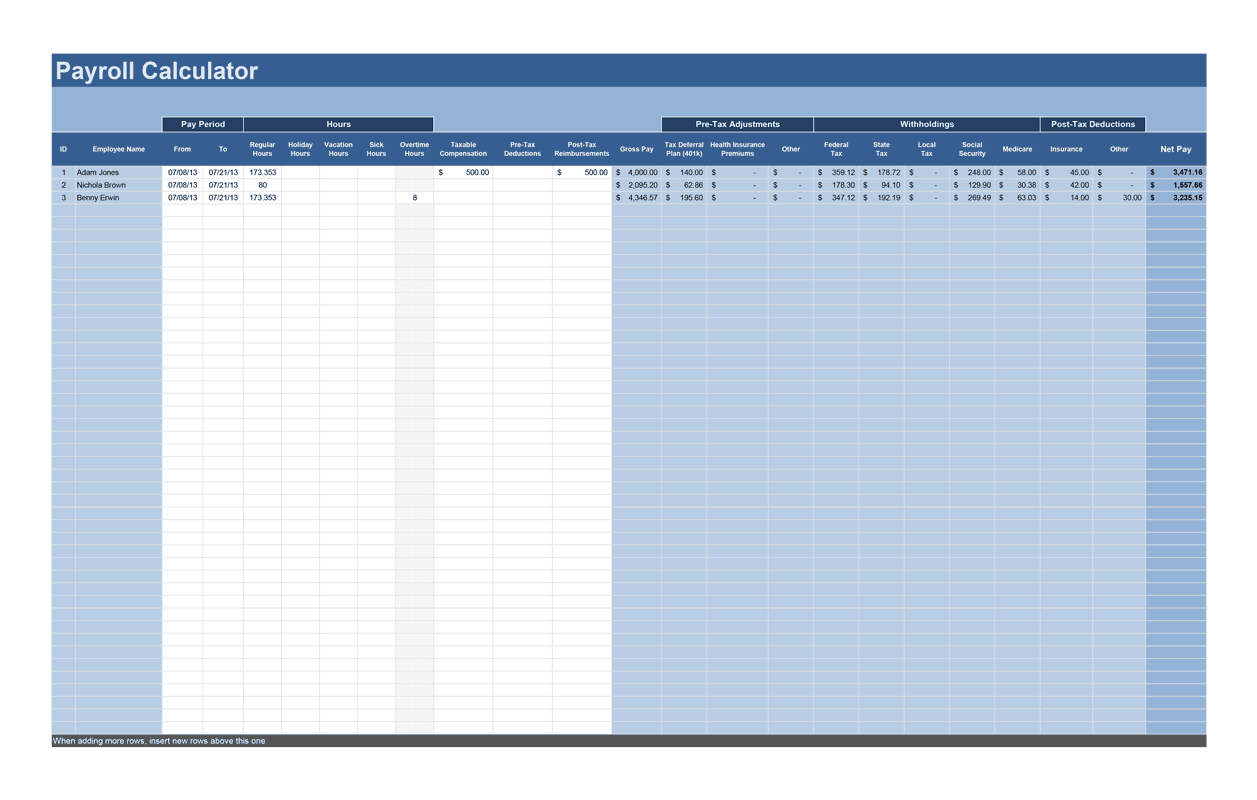

Payroll Calculator Free Employee Payroll Template For Excel

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Here S How Much Money You Take Home From A 75 000 Salary

How To Calculate Payroll Taxes Methods Examples More

Massachusetts Paycheck Calculator Smartasset

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Tax Calculator For Employers Gusto

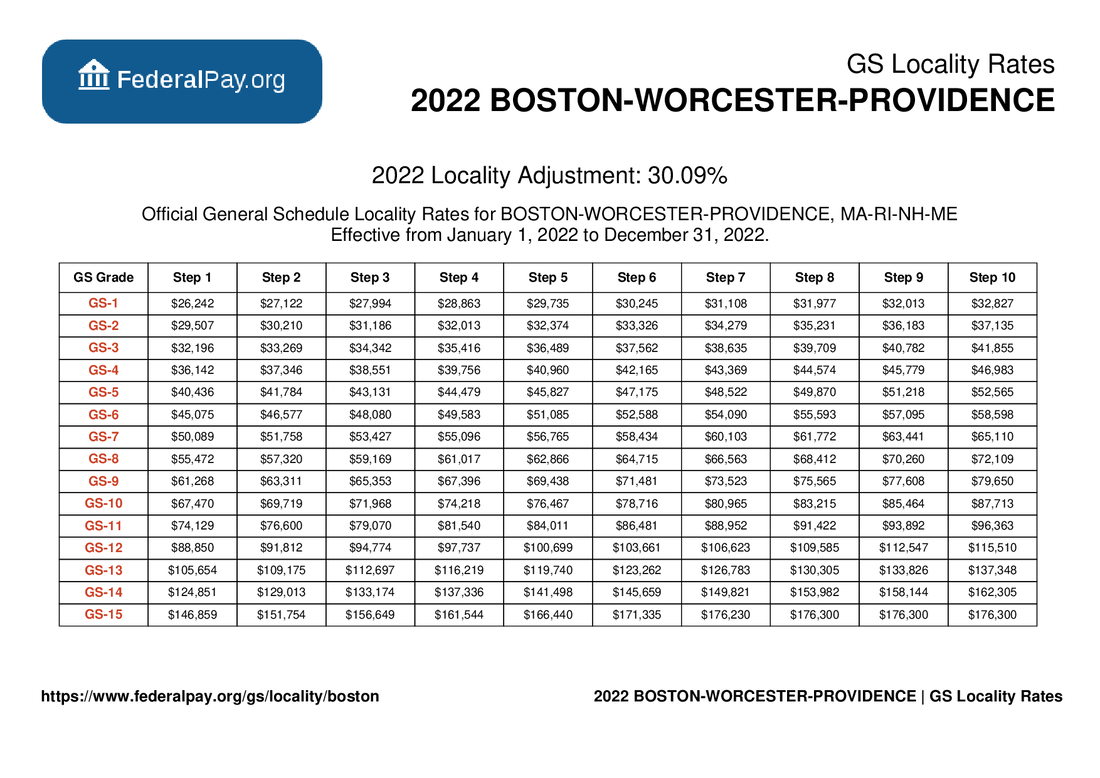

Boston Pay Locality General Schedule Pay Areas

What S Your Rate Of Inflation The New York Times

Massachusetts Sales Tax Small Business Guide Truic

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Medicare Advantage Commission Calculator 2021 Ncc

How To Calculate Payroll Taxes Methods Examples More

Dmv Fees By State Usa Manual Car Registration Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

Medicare Advantage Commission Calculator 2021 Ncc